Featured

Table of Contents

The catch is that not-for-profit Credit history Card Financial debt Forgiveness isn't for every person. To certify, you should not have made a settlement on your charge card account, or accounts, for 120-180 days. Additionally, not all creditors get involved, and it's just used by a couple of nonprofit credit rating counseling agencies. InCharge Financial debt Solutions is among them.

The Credit History Card Mercy Program is for people who are so much behind on debt card repayments that they are in significant economic problem, perhaps facing bankruptcy, and do not have the earnings to capture up."The program is especially created to aid clients whose accounts have actually been charged off," Mostafa Imakhchachen, consumer care specialist at InCharge Financial obligation Solutions, claimed.

Lenders who take part have actually concurred with the nonprofit credit history therapy company to accept 50%-60% of what is owed in dealt with month-to-month settlements over 36 months. The fixed settlements imply you recognize exactly just how much you'll pay over the repayment duration. No passion is charged on the balances throughout the payback duration, so the repayments and amount owed don't alter.

It does reveal you're taking an active duty in decreasing your financial obligation., your credit history rating was currently taking a hit.

Rumored Buzz on The Benefits and Drawbacks of A Season of Gratitude: How APFSC Helps Families Thrive : APFSC

The counselor will assess your funds with you to identify if the program is the right option. The evaluation will include an appearance at your monthly revenue and expenses. The firm will certainly draw a credit score report to understand what you owe and the degree of your hardship. If the forgiveness program is the ideal option, the therapist will send you an agreement that details the strategy, consisting of the amount of the month-to-month payment.

If you miss out on a settlement, the agreement is nullified, and you have to leave the program. If you assume it's a great alternative for you, call a therapist at a not-for-profit credit score counseling firm like InCharge Financial debt Solutions, who can address your questions and help you figure out if you certify.

Since the program permits consumers to choose less than what they owe, the creditors that participate want reassurance that those that make the most of it would not be able to pay the full amount. Your charge card accounts also need to be from financial institutions and bank card business that have actually consented to participate.

How Knowing Your Protections Regarding Debt Forgiveness can Save You Time, Stress, and Money.

Equilibrium must go to the very least $1,000.Agreed-the equilibrium has to be settled in 36 months. There are no expansions. If you miss out on a payment that's just one missed out on repayment the contract is terminated. Your lender(s) will certainly terminate the plan and your equilibrium returns to the original amount, minus what you've paid while in the program.

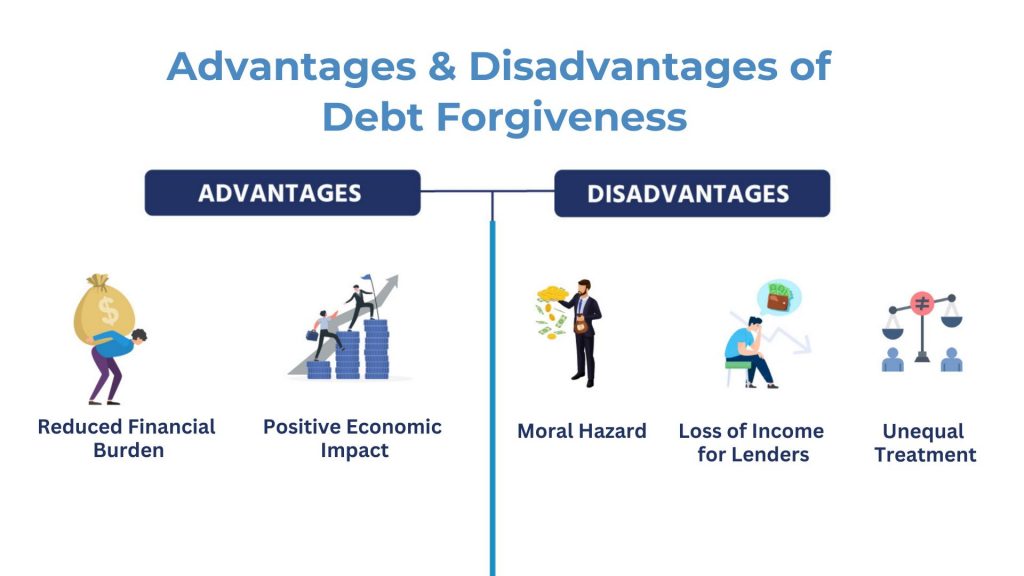

With the mercy program, the creditor can rather select to keep your financial obligation on guides and recover 50%-60% of what they are owed. Nonprofit Credit Card Debt Forgiveness and for-profit financial debt settlement are comparable because they both supply a method to resolve bank card debt by paying much less than what is owed.

Bank card forgiveness is made to cost the consumer less, settle the debt quicker, and have fewer downsides than its for-profit counterpart. Some essential locations of distinction in between Charge card Debt Mercy and for-profit debt negotiation are: Bank card Debt Mercy programs have connections with creditors who have actually accepted get involved.

Little Known Facts About "A Season of Gratitude: How APFSC Helps Families Thrive : APFSC Ruins Your Life" and Other Lies.

Once they do, the benefit duration starts quickly. For-profit debt settlement programs bargain with each financial institution, usually over a 2-3-year period, while passion, costs and calls from financial debt collection agencies continue. This indicates a bigger hit on your credit record and credit history, and a raising balance up until negotiation is finished.

Credit Scores Card Financial debt Mercy customers make 36 equivalent month-to-month payments to eliminate their debt. The repayments most likely to the lenders till the agreed-to balance is eliminated. No interest is billed throughout that duration. For-profit financial debt negotiation clients pay right into an escrow account over an arrangement period towards a lump amount that will be paid to creditors.

Table of Contents

Latest Posts

Fascination About True Testimonials of Debt Relief Recipients

Not known Facts About How Millennials and Credit Card Debt: Building Smart Credit Without Financial Risk : APFSC Preserves What You've Built

Not known Facts About What Legislation Says Under Bankruptcy Law

More

Latest Posts

Fascination About True Testimonials of Debt Relief Recipients

Not known Facts About What Legislation Says Under Bankruptcy Law